By Beatriz Marie D. Cruz

BusinessWorld / 12:01 AM July 8, 2025

These homeowners are spread across 64 cities nationwide, Lhoopa said in an e-mail statement.

About 75% of these buyers previously had no other means of owning a house, the company added.

Founded in 2018, Lhoopa seeks to streamline access to homeownership — from land acquisition to move-in applications — all through a single platform.

It leverages artificial intelligence-enabled tools and a decentralized partner network aimed at closing gaps in affordable housing in the country.

Users can access a suite of features to easily track and manage property listings, oversee construction progress, and monitor legal documentation and payments.

On average, a Lhoopa homebuyer has a monthly income of P20,000 (about $350), a segment largely underserved by the traditional real estate sector, it said.

“People need a straightforward and practical way to buy a home that doesn’t leave them guessing or overwhelmed,” Lhoopa Co-founder and Chief Executive Officer Mark Caillot said in a statement.

“Our technology and network bring together available properties, accessible financing options, and user-friendly tools that simplify each step of the homeownership process,” he added.

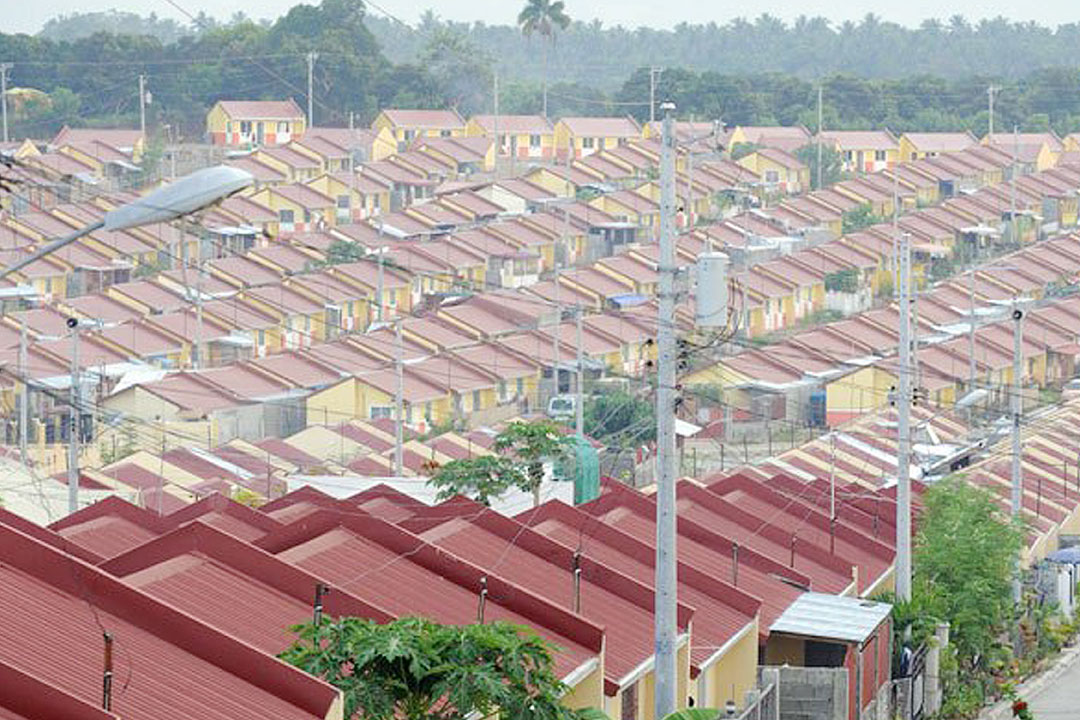

The Philippines faces a housing deficit of 6.5 million units, which could rise to 22 million by 2040 if not addressed, according to the United Nations Human Settlements Programme.

Moving forward, Lhoopa is looking to scale its operations to better support more low- and middle-income Filipinos in need of a home.

“Our focus now is to scale: to continue enhancing our platform and expanding our network of local partners to further bridge the housing backlog, while helping more and more families access safe, quality, and affordable homeownership,” Mr. Caillot said.